Standard deviation measures _____ risk while beta measures ____ risk. – Standard deviation measures diversification risk while beta measures systematic risk. These two measures are essential for understanding the risk and return characteristics of investments.

Standard deviation quantifies the dispersion of returns around the mean, providing insights into the volatility of an investment. Beta, on the other hand, measures the sensitivity of a security’s returns to market fluctuations, indicating its susceptibility to systematic risk.

Understanding Standard Deviation and Beta Risk Measures

Standard deviation and beta are two important measures of risk in finance. Standard deviation measures the dispersion of returns around the mean, while beta measures the sensitivity of a security’s returns to market fluctuations.

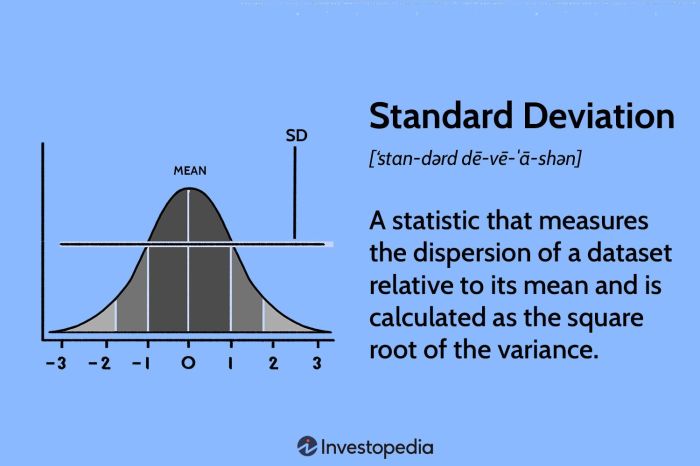

Standard Deviation: Measuring Dispersion of Returns: Standard Deviation Measures _____ Risk While Beta Measures ____ Risk.

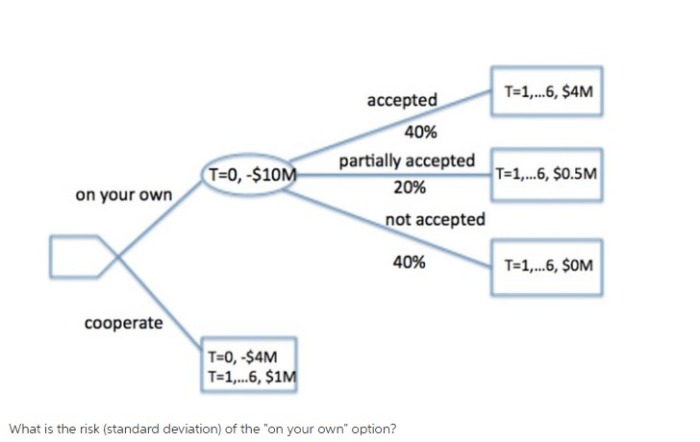

Standard deviation is a statistical measure that quantifies the dispersion of data points around the mean. In the context of financial returns, standard deviation measures the volatility of returns. A higher standard deviation indicates that the returns are more volatile, while a lower standard deviation indicates that the returns are more stable.

Calculating Standard Deviation, Standard deviation measures _____ risk while beta measures ____ risk.

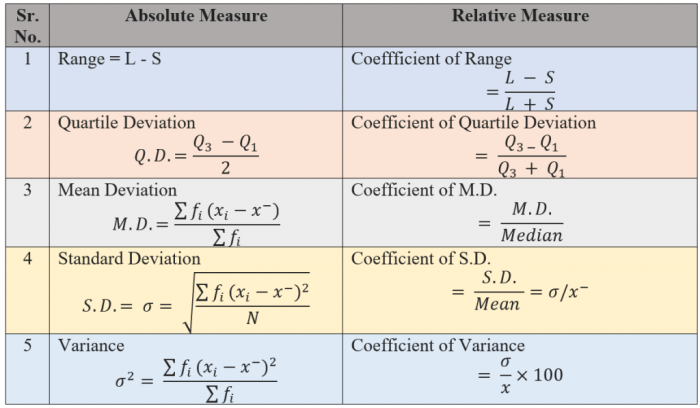

Standard deviation is calculated using the following formula:

σ = √(Σ(x

μ)² / N)

where:

- σ is the standard deviation

- x is the return

- μ is the mean

- N is the number of observations

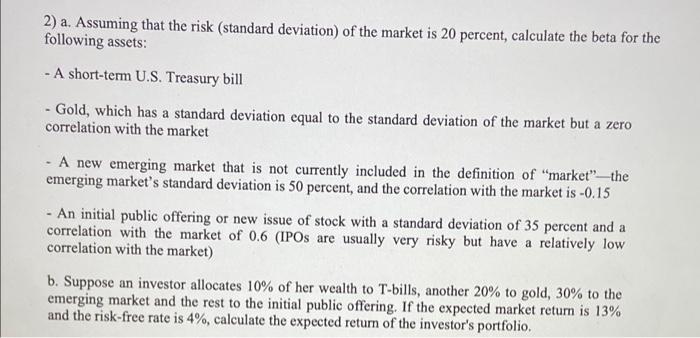

Beta: Measuring Systematic Risk

Beta is a measure of systematic risk, which is the risk that cannot be diversified away. Systematic risk is caused by factors that affect the entire market, such as economic conditions, interest rates, and political events.

Calculating Beta

Beta is calculated using the following formula:

β = Cov(r, rm) / Var(rm)

where:

- β is the beta

- r is the return on the security

- rm is the return on the market

- Cov is the covariance

- Var is the variance

FAQ Compilation

What is the difference between standard deviation and beta?

Standard deviation measures the dispersion of returns around the mean, while beta measures the sensitivity of a security’s returns to market fluctuations.

How is standard deviation calculated?

Standard deviation is calculated by taking the square root of the variance, which is the average of the squared differences between each return and the mean return.

How is beta calculated?

Beta is calculated by measuring the covariance between the returns of a security and the returns of a benchmark, typically a market index, and dividing it by the variance of the benchmark.